Jupiter Swap how is rapidly becoming a pivotal platform for anyone engaged in the Solana ecosystem. This decentralized exchange (dex) stands out by offering an unparalleled user experience and a wide array of trading options. Designed to facilitate efficient swaps while maintaining low transaction fees, it enables users to truly leverage the full capacities of their crypto assets. With a robust and scalable infrastructure, JupiterSwap is setting new standards for speed and reliability in decentralized trading.

The integration with Solana blockchain ensures that JupiterSwap provides remarkable efficiency, handling thousands of transactions per second. This ensures rapid order fulfillment, an essential feature for traders looking to capitalize on market shifts. What’s more, the intuitive interface and accessible features make it a versatile choice for both seasoned traders and newcomers, simplifying the process of exchange without sacrificing advanced capabilities.

One of the key advantages of utilizing JUP is its ability to aggregate liquidity across a wide spectrum of platforms. This means users can execute trades with optimum swap rates, minimizing slippage and maximizing returns. Coupled with the security and transparency inherent in the dex model, JupiterSwap presents a reliable choice in the ever-competitive landscape of digital trading platforms. Dive into a seamless trading experience and explore the endless possibilities at your fingertips with JupiterSwap.

Jupiter Swap: Understanding the Core Concept

Jupiter Swap to effectively utilize on the Solana blockchain, focus on its unique decentralized exchange (DEX) model, designed for seamless and swift token swapping. The platform primarily serves as an aggregator, consolidating multiple DEX and swap platforms into a single interface, thereby optimizing asset exchange rates and minimizing transaction fees.

At the heart of JupiterSwap, the JUP protocol ensures efficient price discovery by leveraging liquidity pools across the Solana ecosystem. This integration allows for competitive pricing and improved slippage control. Users can experience real-time market conditions through the platform’s algorithm, which routes trades through the most efficient paths available.

By prioritizing transparency and security, JUP bolsters user confidence in decentralized trading. With non-custodial management of funds, users retain complete control over their crypto assets. The user-centric design, coupled with cutting-edge technology, fosters a streamlined experience that empowers traders of all levels.

Jupiter Swap - How Integrates with Solana Blockchain

Jupiter Swap maximize efficiency by leveraging the integration within the Solana ecosystem. JupiterSwap operates effectively by taking advantage of Solana’s high-speed and low-cost architecture, ensuring rapid and inexpensive transactions. By utilizing Solana’s proof-of-history consensus mechanism, the DEX achieves significant scalability, processing thousands of transactions per second.

Utilize the Jupiter exchange to conduct swift and seamless token swaps across multiple Solana-based DEXs. This integration allows you to connect with liquidity pools effortlessly, optimizing trading routes using the intelligent routing features inherent to JupiterSwap. By tapping into this functionality, you empower your trading strategy with enhanced liquidity access and best price discovery, minimizing slippage and maximizing returns.

Key Integration Points

First, explore the API offerings which facilitate direct application integration within the Solana ecosystem. This provides builders with tools to incorporate JupiterSwap’s capabilities in decentralized applications (dApps) without hassle. Additionally, Solana’s cross-chain compatibility broadens accessibility, allowing for seamless interaction with various blockchain tokens through Jupiter’s robust infrastructure.

Take advantage of the integration capabilities between the smart contract systems inherent to both Solana and Jupiter, which enables programmable, automated trading strategies that align with specific market conditions. This allows developers and traders alike to create bespoke solutions that fit unique trading requirements, leveraging the automation and precision of decentralized finance.

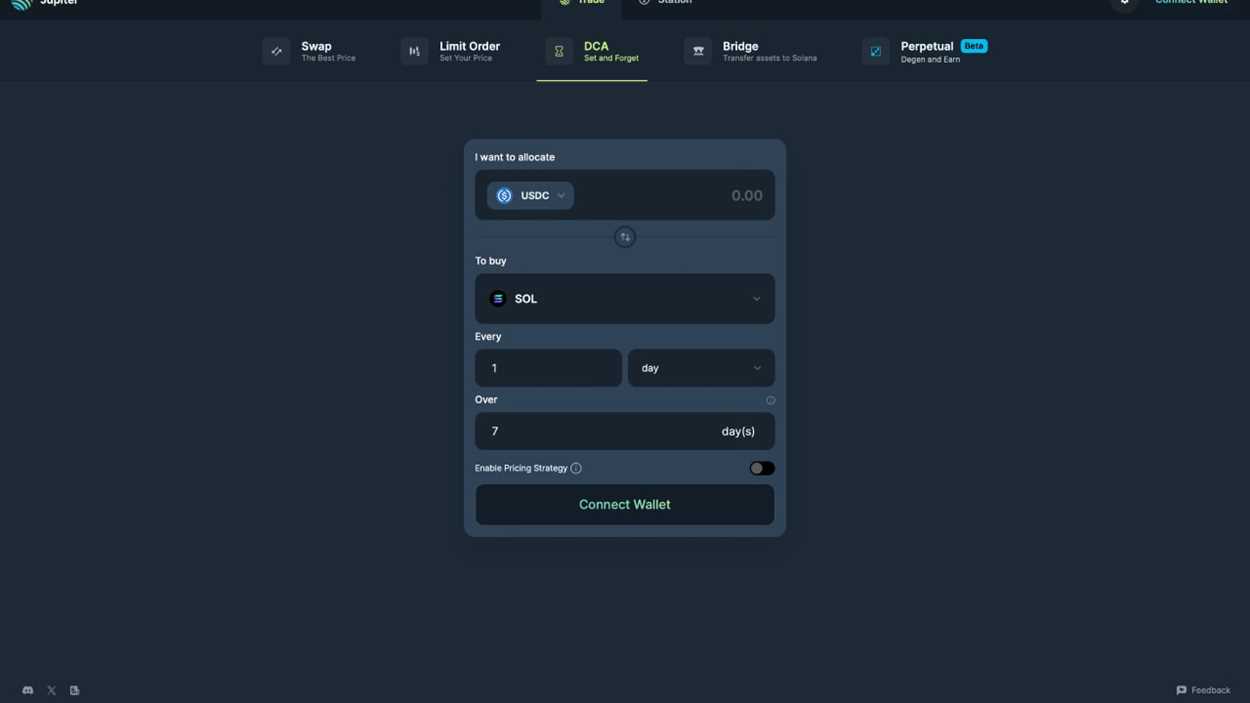

Navigating the User Interface of Jupiter Swap

Access the main dashboard on jupiterswap by connecting your digital wallet, with JUP and SOLANA being popular choices. Ensure the wallet is compatible to engage in seamless swap and exchange operations.

Understanding the Dashboard Layout

- Top Bar: Displays wallet connectivity status and current balance in SOLANA and JUP tokens, providing quick access to settings and notifications.

- Navigation Menu: Presents options for swap functionalities, historical exchanges, and analytical tools, allowing for efficient management of transactions.

- Market Indicators: Features real-time updates on token prices, market trends, and essential analytics to aid in informed decision-making.

Executing a Transaction

- Select Tokens: Choose your desired token pairs for swapping, such as JUP to SOLANA or vice versa, ensuring liquidity availability.

- Input Amount: Enter the quantity and review potential fees and exchange rates provided by the jupiterswap platform.

- Preview Transaction: Carefully review transaction details, including slippage and estimated completion time, before proceeding.

- Confirm Swap: Authorize the transaction via your connected wallet to execute the exchange on the SOLANA network.

For advanced users, delve into the settings for customization options, enhancing the trading experience. Utilize available resources, such as support and community forums, for any challenges encountered on jupiterswap.

Security Measures Implemented in Jupiter Swap

To ensure robust protection of transactions on the Jupiterswap platform, it's imperative to verify the authenticity of smart contracts utilized during swaps. Using Solana's blockchain infrastructure enhances resistance to common threats faced by decentralized exchanges. Suppliers and developers are urged to conduct regular audits of code, minimizing potential vulnerabilities.

Advanced Encryption

Emphasizing security, Jup employs advanced encryption algorithms in data transmission, safeguarding user information within its ecosystem. Security layers are fortified by industry-standard protocols to further ensure sensitive data integrity.

Decentralized Asset Storage

Assets involved in transactions remain in decentralized custody, reducing the risk of centralized breaches. Embracing Solana’s distributed technology enhances trust and reliability by leveraging a decentralized model to protect against single points of attack.

Implementing Two-Factor Authentication (2FA) adds an additional protection layer for account access–users are advised to activate 2FA and routinely update their security settings.

How to Execute a Trade on Jupiter DEX

To successfully trade on Jupiter DEX, connect your wallet by navigating to the official Jupiter page using a Solana-supported browser extension. Upon connection, locate the trading interface designed for swap transactions. Select the tokens you wish to exchange, ensuring your wallet holds sufficient balance and account permissions for the chosen assets.

Set the slippage tolerance to account for potential market fluctuations. A common range is between 0.1% and 1% depending on the market conditions and your risk preference. Verify that the quoted price is satisfactory before proceeding.

Click the swap button to initiate the transaction. Your wallet may prompt for authorization; consent to finalize the operation. After confirmation, monitor the transaction status on the Solana blockchain explorer using the supplied transaction ID. This ensures transparency and traceability of your exchange within the Jupiter trading platform.

Should any issues arise during the process, refer to Jupiter's support portal for assistance and guidance from their resources.

Comparing Jupiter Swap to Traditional Swap Platforms

For users searching for liquidity solutions on Solana, utilizing JupiterSwap can offer distinct advantages over conventional swap mechanisms. The decentralized exchange (DEX), jupiter, facilitates high-speed transactions, leveraging the Solana blockchain’s capabilities to maximize efficiency and speed compared to legacy platforms.

Core Attributes and Efficiency

| Feature | JupiterSwap (DEX) | Traditional Platforms |

|---|---|---|

| Transaction Speed | Fast execution via Solana | Slower due to network congestion |

| Liquidity Accessibility | Aggressive liquidity pool aggregation | Isolated pools, limited access |

| Fees | Lower fees due to decentralized nature | Higher fees involving intermediaries |

Security and User Experience

In terms of safeguarding and overall experience, jup ensures improved security measures inherent to decentralized frameworks, reducing risks associated with central control. By eliminating intermediaries, users enjoy greater anonymity and security, aspects that are often lacking on traditional exchanges.

Additionally, the intuitive interface of jupiterswap enhances user interaction, making the transaction process seamless and user-friendly, matching or exceeding the usability typically found in older systems.

In evaluating these platforms, opting for a DEX like jupiter presents measurable benefits in efficiency, cost, and security while avoiding unnecessary complications characteristic of traditional swaps. The strategic choice lies in embracing these emerging platforms to better align with modern financial objectives.

Liquidity Options Available on Jupiter Swap

When utilizing JupiterSwap, prioritize leveraging its robust liquidity pools on the Solana blockchain to achieve optimal swap efficiency. JupiterSwap uniquely integrates multiple liquidity sources, allowing seamless exchange transactions with minimized slippage. This capability is vital for traders seeking competitive rates on Solana's DEX ecosystem.

Integrated DEX Solutions

Evaluate JupiterSwap's integration with leading DEX platforms to exploit diverse liquidity channels, thereby enhancing your trading experience. By connecting to an expansive network within the Solana framework, JupiterSwap ensures access to a wide variety of tokens and competitive price discovery.

Smart Routing Techniques

Capitalize on JupiterSwap's advanced smart routing technology, designed to automatically select the most efficient trading paths across all connected liquidity sources. This method not only boosts execution speed but also optimizes the cost-efficiency of each transaction, making it a preferred choice for savvy traders.

Exploring Fee Structures in Jupiter DEX

Understanding the fee model in Jupiter DEX is essential for optimizing trading strategies. The platform typically operates without a base transaction fee, allowing users to focus on price optimization across the Solana ecosystem. However, fees can be incurred due to Solana's network costs and liquidity provider obligations.

- Network Fees: Solana's network charges a minimal fee for processing transactions. This fee is comparatively lower than many other blockchains, making it favorable for frequent trades.

- Liquidity Provider Fees: When users execute a swap, liquidity pools charge a fee proportional to the swap size. These fees are shared among liquidity providers, incentivizing pool participation.

- Slippage Costs: Price fluctuations during transaction execution may result in slippage, leading to unexpected trade costs. Utilizing Jupiter DEX's routing technology can mitigate some slippage risks by selecting optimal pathways.

Traders should closely monitor these fees, factoring them into their overall strategy to maximize the benefits of using JupiterSwap. For the most current and detailed information about fees and trading processes, refer to the official Jupiter website.

How Jupiter Swap Enhances User Privacy

Choose JupiterSwap on the Solana blockchain to prioritize confidentiality. Unlike traditional exchanges that require extensive personal data, this decentralized platform minimizes the information shared with third parties, enhancing anonymity. By utilizing smart contracts, Jupiter ensures that peer-to-peer transactions remain private and secure. This eliminates intermediaries, reducing the risk of unauthorized access.

The advanced DEX framework allows users to exchange cryptocurrencies directly from their wallets. This ensures control over funds, which eliminates the necessity of sharing sensitive data with centralized platforms. Additionally, JupiterSwap's robust encryption mechanisms protect communications from potential breaches.

Opt for Jup tokens within the platform for added privacy layers. These utility tokens facilitate seamless interaction while maintaining high security standards. Furthermore, leveraging Solana's infrastructure provides JupiterSwap users with rapid and low-cost transactions, eliminating the typical inefficiencies of older systems.

For an added privacy edge, consider combining the platform's features with hardware wallets. This strategy expands transactional privacy while maintaining asset security under user's direct control.

Using Jupiter Swap for Cross-Chain Transactions

For seamless cross-chain transactions, utilize jupiterswap to convert assets across different blockchains efficiently. This decentralized exchange (DEX) allows users to perform swaps directly from one chain to another without the need for intermediaries, reducing time and costs.

Effortless Asset Conversion

With jup, you can effortlessly transition assets between chains, leveraging its ability to handle a multitude of token standards. This functionality is pivotal for accessing diverse blockchain ecosystems directly, providing a unified user experience.

Security and Decentralization

Jupiterswap prioritizes user security by employing decentralized protocols that ensure asset protection during exchanges. Users maintain control over their assets throughout the swap process, minimizing risks associated with centralized exchanges.

Q&A:

What are the main features of Jupiter Swap that set it apart from other decentralized exchanges?

Jupiter Swap offers several distinctive features that differentiate it from other decentralized exchanges. First, it operates on the Solana blockchain, known for its high-speed and low-cost transactions. This allows users to enjoy almost instantaneous trades with minimal fees. Furthermore, Jupiter Swap is designed with user-friendliness in mind, providing an intuitive interface that is accessible to both new and experienced traders. Additionally, it aggregates liquidity from multiple sources, ensuring better price execution and reducing slippage. The platform also offers support for various types of orders and trading pairs, catering to diverse trading strategies.

Can you explain how liquidity aggregation works on Jupiter Swap and why it's beneficial?

Liquidity aggregation on Jupiter Swap functions by collecting liquidity from multiple decentralized exchanges into a single platform. This means that trading orders are potentially matched with the best available prices across these sources, rather than being restricted to the liquidity of a single exchange. The primary benefit of such an approach is that it enhances the likelihood of executing trades at more favorable prices, with reduced slippage. By securing better trade execution, users can maximize their returns and enjoy a smoother trading experience overall.

Is Jupiter Swap suitable for users who are new to cryptocurrency trading?

Yes, Jupiter Swap is designed to be accessible for users who are new to cryptocurrency trading. The platform's user interface is intuitive and straightforward, making it easy for newcomers to navigate. Educational resources and guides are available to help beginners understand the basic concepts of trading and using a decentralized exchange. Additionally, the support for various order types and an extensive range of trading pairs also allows users to explore different trading options suited to their level of expertise.

Why is Solana considered a good choice for running a decentralized exchange like Jupiter Swap?

Solana is considered an excellent choice for running decentralized exchanges like Jupiter Swap due to its high throughput and low transaction costs. Solana's blockchain can handle thousands of transactions per second, which significantly reduces the likelihood of network congestion and transaction delays. The low fees associated with transactions on Solana make it particularly attractive for frequent traders who need to execute many trades without incurring prohibitive costs. This combination of speed and affordability makes Solana a strong foundation for decentralized trading platforms.

How does Jupiter Swap ensure security for its users and their assets?

Jupiter Swap implements multiple layers of security to protect its users and their assets. The platform utilizes smart contracts that are rigorously tested and audited for vulnerabilities, ensuring that they function correctly and securely. Additionally, being a decentralized exchange, Jupiter Swap does not hold custody of users' funds; instead, users maintain control over their wallet keys and assets, minimizing the risk of centralized breaches or hacks. Regular security updates and responsive support further contribute to maintaining a safe trading environment for all users.

What are the key features that distinguish Jupiter Swap from other decentralized exchanges?

Jupiter Swap offers unique features, such as its integration with the Solana blockchain, which allows for fast and low-cost transactions. This integration also facilitates access to a wide range of liquidity sources, enhancing trading opportunities. Additionally, Jupiter Swap's smart routing algorithm optimizes trades to ensure the best possible prices for users, distinguishing it from many competitors that lack such advanced functionalities.

How does Jupiter Swap enhance the user trading experience on Solana?

By leveraging the speed and low transaction costs of the Solana blockchain, Jupiter Swap significantly improves the trading experience. Users benefit from almost instant transactions and negligible fees, making it more cost-effective and efficient for traders who are used to slower, more expensive transactions on other platforms. The intuitive user interface also contributes to a seamless trading experience, even for those new to decentralized exchanges.

What benefits does Jupiter Swap provide for liquidity providers?

Jupiter Swap offers liquidity providers the advantage of earning fees on trades that pass through their liquidity pools. By participating in these pools, providers can earn a portion of the transaction fees proportional to their share in the pool. Additionally, the platform's growing user base and integration with various liquidity pools enhance the potential for greater trade volume and, consequently, increased earnings for liquidity providers. Furthermore, Jupiter Swap's integration with Solana ensures that liquidity providers experience minimal network congestion and costs, compared to other blockchain networks.